Reducing Your Credit Card Debt

Credit card debt in America is reaching record proportions. According to the American Household Credit Card Debt Statistics, the average household is over $15,000 in debt. Perhaps you owe something around that number, and are desperate to get that number down or at least cure your debt increasing habits.

If you are so far into debt that you are considering drastic measures, the first step towards recovery is to stop charging immediately. Although this will be a challenge, you're better off going hungry for a few days than ruining your credit score.

Really think about what you truly need to survive and stop all non-essential purchasing. Make it your goal to pay well above the minimum payment on the credit card. My rule of thumb is to pay triple the minimum payment. This of course really depends on how far into debt you are. I usually pay about 80% of what I charged for the month and then by the time tax season rolls around I use a chunk of my refund to pay off the balance completely.

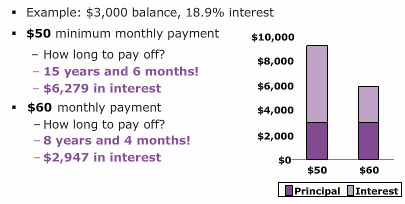

Paying more than the minimum payment cannot be emphasized enough! You may be surprised just how much money you are paying just in interest if you only make the minimum payment. Take a look at this chart:

In this case, do you see the impact adding a mere $10 to the payment has? Not only did you save yourself thousands of dollars but you paid off the loan almost 7 years earlier. If you have experience something similar due to increasing your minimum payments, share your thoughts in a comment!

RSS Feed

RSS Feed