Budgeting helps keep a Stress Free Financial Life

Budget, it seems to be a word used a lot to explain why some people are in debt and others are not in debt. Some people seem to be financial savvy and stay out of debt. While most of us are in so much debt we feel we may never pay if all off. If you are like me, I was not financial savvy and on my way to college. I knew I did not want to get into too much debt along with living expenses. So I started to look into budgets, living expenses and how to manage your money. Budgets help keep a stress free financial life, if you know how to budget, if you know how to budget your living expenses, and if you know how to managing your money.

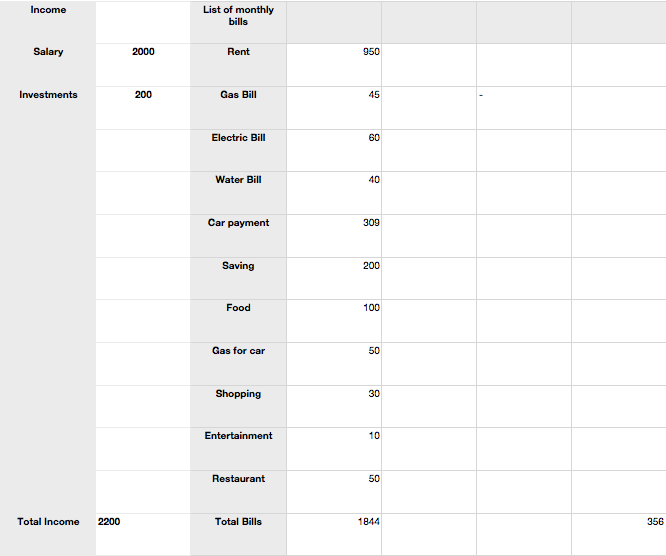

A budget by definition is an estimate of income and expenses for a set time period(dictionary.com). On a spreadsheet you can make a budget. A budget is very basic math even an elementary student can do it. To start a budget make a list of all your bills. Then you need to add them together to get your total amount of money you spend in bills. Next subtract the total amount of bills from your total income amount. If your bills are higher than your total income, you need to cut back on your spending. This is were budgeting your living expenses can help you keep a better budget.

Living expenses are your basic needs. This would be rent,electric bill,gas bill,water bill and food. When I look at all of my expenses, I have a little insight on how to budget them correctly. First, rent should be no more then what you make in one week, but it can be less. Second, all of your utility bills should be half of what you make in one week. Lasted, food should be no more than the other half of one week pay. This might be hard to do at first but just start slow and work it out. This will help you manage your money.

Managing your money is where you are saving, paying off debt and look forward into the future. When I save money, I take a percentage out of every paycheck and place it in a saving account. I started off with just five percent and have worked to twenty percent. When paying off debt there are a few things you should know. First, the minimum payment does not pay off your credit card or debt. You need to make a high payment as to start paying off the principal amount. Second, don't use credit cards while you are paying them off. This only creates more debt and does not allow you to pay the credit cards off. Last, learn to live with in your means. This will stop debt or credit care usage. When you have payed off your debt or credit cards, you can start looking in to the future to invest, buy a house and start a retirement plan. When living on a Budget you will feel stress free and financially happy.

Budget are an easy way to live your life. When living on a budget you can manage your money, know your living expenses and know how to budget like the financial savvy person. Living expenses become easy when you know how much money to manage for each. Managing your money will allow you to get out of debt and pay off those credit cards. Budget help you know where your money is being spent and how much you are saving. Now you can have a Stress free financial life.

RSS Feed

RSS Feed